Meanwhile Whelan told The Observer newspaper that Ashley had encouraged him to let the chain he founded go bust. The Sunday Times said that Ashley had made a £80m bid for JJB Sports’ gym club business before Christmas but said that no deal was agreed and that Ashley was subsequently frozen out of the auction, with Whelan given exclusivity on a deal.

Sources suggest Whelan will buy the business by Wednesday this week. The future of the entire JJB Sports chain rests on the Whelan deal completing this week – without it JJB Sports will not have the cash to pay its bank loans or its landlords cash due this week and it will collapse into administration. The facility has now been amended to a 3-year £25 million facility expiring on September 30, 2012.Reports over the weekend suggested Sports Direct founder Mike Ashley had written to JJB’s landlords asking them not to reassign leases to Dave Whelan, the original founder of JJB, who is close buying back JJB’s gym business for £70m. The company will use the net proceeds of approximately £94 million to pay down its £30.5 million borrowings with Bank of Scotland. JJB also stated that 400 million new ordinary shares of 5 pence were listed on the London Stock Exchange on November 3 following the successful £100 million capital raising on October 28. The company is beginning to take delivery of the new stock as the stock holding has improved from the half year's GBP 50 million and is now 19% lower than the last year. However, this was 90 basis points lower than the comparable period last year. 26 and the company expects to launch the new Spring ranges before the end of January.įurther, JJB said that since the first half of the year, overall gross margin improved by 12 percentage points to 46% for the 20-week period. Meanwhile, this year's sale will start on Dec. JJB also stated that like-for-like sales showed a 32% slide in the first three weeks of December as last year's sale started on Nov.

This represented a 22.6 drop from £466.6 million (849. While August like-for-like sales decreased 37%, September and October like-for-like sales dropped 27% and November like-for-like sales slid 21%. Citing poor retail locations and limited growth capability based on prior liabilities, JJB Sports posted retail sales of £361.1 million (570.2 mm) for the 53 weeks ended Jan. Break some necks every season, all year long, in the latest and greatest apparel and accessories from the brands you love.

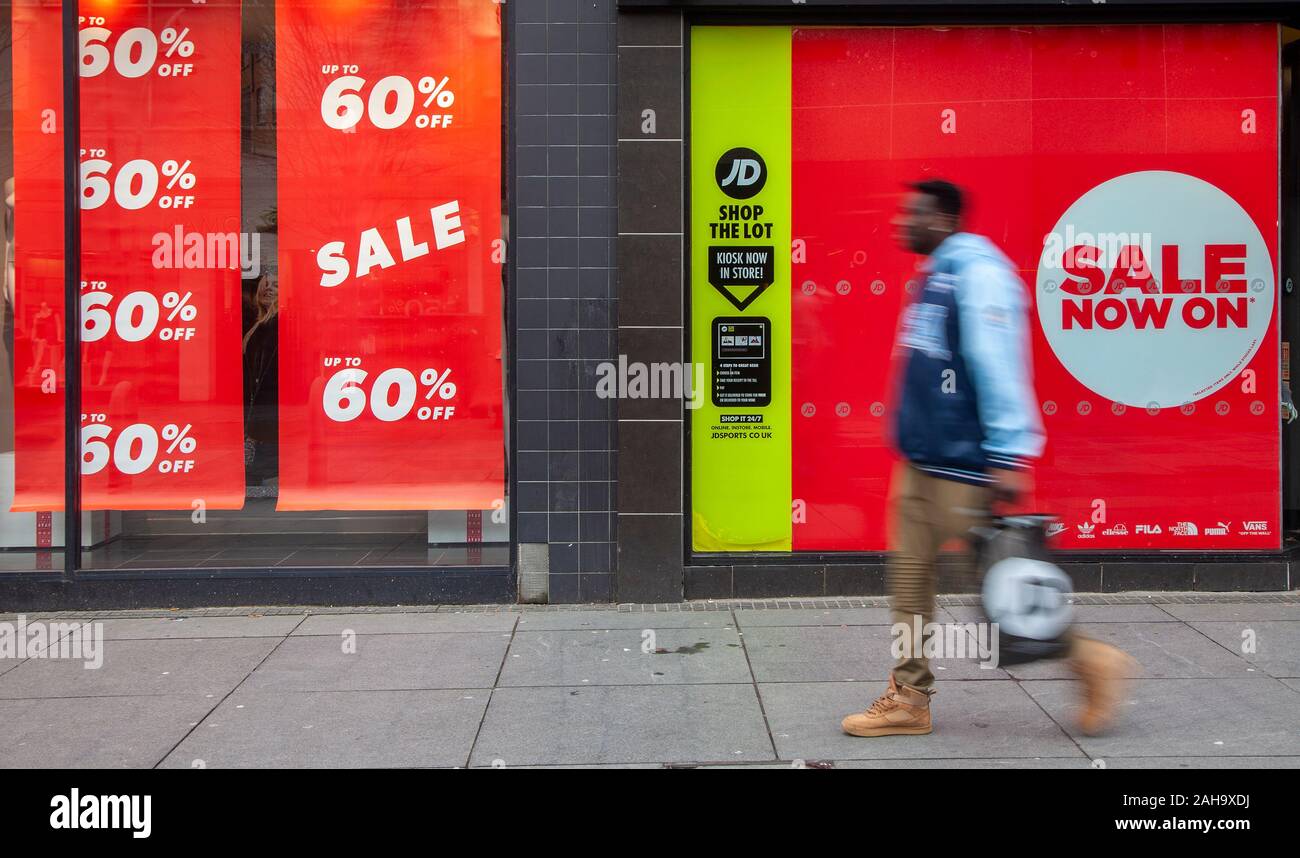

Mit vielen exklusiven Modellen von Topmarken wie Nike und adidas. With sportswear like joggers, hoodies, leggings and so much more, JD Sports is more than just a sneaker store. Company’s officials informed investors that JJB Sports’ shares might be worthless. JJB Sports said that like-for-like sales have shown some improvement since the half year. JD Sports ist einer der führenden Einzelhändler für Sneaker und Sportbekleidung. JJB Sports put itself up for sale on Thursday. Overall, revenues were down 52% in the 20-week period. However, it is likely to be by way of a ‘pre-pack’ administration. The UK-based sports retailer also said that it remains cautious about Christmas and New Year and expects difficult trading within the current environment. JJB Sports is close to striking a deal to sell its sporting goods business, with terms set to be agreed early next week. 13, compared to the same period last year. JJB Sports Plc said that on a like-for-like basis, the company's revenues were down 29% for the 20-week period ended on Dec.

0 kommentar(er)

0 kommentar(er)